Author Name:Tiffany Lee – Marketing Analyst at FreightAmigo

Toys Industry – Import and Export Trade

Toys are a global industry that involves production and sales in different countries and regions. According to data from the Hong Kong Trade Development Council, Hong Kong is one of the world’s largest toy import and export trading centers, accounting for about one-third of the global market. Here are some key data and trends on the import and export trade of the toys industry:

- 2020, Hong Kong’s total toy import and export trade was approximately HKD 28.9 billion, a decrease of about 2% from 2019. This was mainly due to the impact of the COVID-19 pandemic on global trade and the impact of the US-China trade friction.

- Hong Kong’s main toy import sources include Mainland China, Vietnam, and Thailand, among other Southeast Asian countries. Mainland China is the largest toy import source, accounting for about 65% of the total import value.

- Hong Kong’s main toy export destinations include the United States, Europe, and Japan, among other countries and regions. The United States is the largest export destination, accounting for about one-third of the total export value.

- Electronic toys are the main category of toys exported from Hong Kong, accounting for about one-quarter of the total export value. Traditional toys (such as puzzles, models, etc.) and infant toys (such as rattles, rockers, etc.) are also major categories of exports.

- Although the COVID-19 pandemic has had some impact on global trade, the toys industry has still performed strongly during the pandemic. According to data, global retail toy sales in 2020 increased by about 4% compared to 2019.

Overall, the toys industry in Hong Kong continues to maintain a strong performance in import and export trade and is expanding its global market share. In the future, with the continued recovery of the global economy and the increasing demand for toys from consumers, the toys industry in Hong Kong is expected to achieve even better development.

Want To Compare The Best Express, Air Freight, Sea Freight, Rail Freight & Trucking Rates So As To Have Better Control On Cost?

Toys Industry and CEPA

Under the Closer Economic Partnership Arrangement (CEPA) between Mainland China and Hong Kong, all products originating from Hong Kong, including toys, can be imported into Mainland China duty-free. Hong Kong manufacturers can apply for zero-tariff treatment for products that have not yet established rules of origin under CEPA, if they meet the agreed CEPA rules of origin through established procedures.

The rules of origin applicable to toys that can enjoy CEPA tariff preferences are the same as those for similar products exported from Hong Kong. Generally, for toys made from textile fabrics, the main production processes for determining their origin are cutting and sewing, which must be carried out in Hong Kong. For toys made from plastic sheets, the main processes are cutting the plastic sheets, connecting them with heat-sealing methods, and attaching air nozzles, which must also be carried out in Hong Kong.

Measures taken by various regions for toy trade are as follows:

In the United States, all toys supplied for children aged 12 and under must undergo third-party testing and obtain a Children’s Product Certificate (CPC) certification to comply with federal toy safety standards and other applicable regulations set by the US Congress. All children’s toys manufactured or imported into the US on or after February 28, 2018 must undergo testing and certification. In 2008, the Consumer Product Safety Improvement Act (CPSIA) came into effect, changing the voluntary toy safety standards in effect at the time to a nationally enforced mandatory children’s product safety regulation.

In the European Union, toys must comply with the safety standards of the Toy Safety Directive in order to be sold in the EU market, while also complying with other applicable EU legislation. The directive supplements and adds to existing provisions on toy warning labels and importer responsibilities. In addition to expanding general safety regulations, the directive also sets requirements for physical and mechanical characteristics, flammability, chemical properties, electrical properties, hygiene, and radioactivity, and imposes stricter regulations on chemical hazards. Manufacturers can use EU harmonized standards to complete self-verification or third-party verification through recognized bodies to comply with these requirements. All toys sold in the EU must be accompanied by the CE mark, which is the manufacturer’s declaration of compliance with basic safety requirements for toys.

In Japan, toys for children aged 6 and under that may come into direct contact with children’s mouths must comply with the Japanese Food Sanitation Law, while toys for children aged 7 and above must comply with the Toy Safety Standards. The Toy Safety Standards set out requirements for physical and mechanical properties, flammability, chemical properties, electrical properties, and radioactivity. Manufacturers must conduct safety tests in accordance with these standards and obtain certification from a designated certification body before their toys can be sold in the Japanese market.

In China, zero-tariff policies are implemented for toy products from countries and regions that enjoy Most Favored Nation treatment. All products in the Compulsory Product Certification (CCC) catalog must be sent to designated testing centers for testing. After obtaining CCC certification and printing the CCC logo, the products can be imported into China and sold in the Chinese market. In addition, there are some voluntary toy safety standards in China, such as GB 6675-2014 “Toy Safety” and GB/T 29872-2013 “Infant and Child Products Safety”, which are intended as references for manufacturers and consumers. Furthermore, China has strengthened its supervision of imported toys, establishing an import toy inspection mechanism to ensure that imported toys meet China’s safety standards and regulations.

Logistics considerations for the toy industry (including toys with batteries):

• Toys with removable batteries:

Separate the battery from the toy directly.

Separate the battery from the toy using insulating material (such as film, tape)

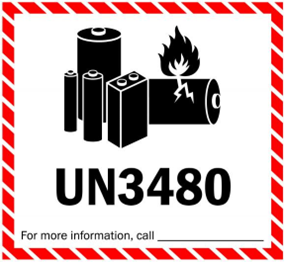

• Toys with non-removable lithium batteries:

Products with less than 5kg/100wH require a lithium battery product shipping label to be downloaded.

The battery net weight exceeds 5kg or 100wH needs to fill in the MSDS file.

FreightAmigo’s Services for the Wine Industry:

- Visible and controllable logistics management

- One-stop value-added services, simplifying processes

- Your 24×7 private logistics expert

- Automated status updates

- Customized logistics solutions

There Are Different Options For Cargo Transportation. If You Want To Choose The Most Convenient And Suitable Solution, It Is Best To Have The Full Support Of Logistics Experts! If You Are Planning To Ship Goods Overseas, Please Go To The FreightAmigo Page For Inquiries.

Read more:

【Sending Musical Instruments 】Complete Guide to Shipping Musical Instruments

===

If you have any inquiries on logistics/supply chain, feel free to contact FreightAmigo now:

Chat with us online OR

Phone : +852 28121686

WhatsApp: +852 27467829