Author Name: Tiffany Lee – Marketing Analyst at FreightAmigo

The European Union is ready to implement the Carbon Border Adjustment Mechanism (CBAM) in 2023. This strategy shows its obligation in tackling climate change and increasing enterprises’ low carbon awareness. Starting from 2023, when you import carbon-intensive products into the EU, carbon border tax may apply! What is it? How does it affect the world?

Let’s learn more about carbon border tax and its effects on countries and businesses with FreightAmigo and make trade greener together!

What is Carbon Border Tax?

To lower carbon emissions, carbon-intensive imports like cement, steel, aluminum, oil refining, paper, glass, chemicals, and fertilizers are subject to import duty. Carbon border tax will apply starting from January 2023 and implement fully by 2026. Countries that are subject to the carbon border tax are those non-EU members and nations that are on track to sustainable development goals. Numerous developed countries, such as the US, the UK and Japan, show their support for the EU’s CBAM.

Impact of Carbon Border Tax on Countries

Impact on Developed Countries

Although carbon border tax helps achieving sustainable development goals, a report from United Nations Conference on Trade and Development (UNCTAD) noted that the tax has the potential to change EU trade patterns. It will benefit low carbon emissions countries rather than developing countries, such as Russia, China, Turkey and Indonesia. This is because they export large amounts of chemicals, steel, and aluminum to the EU. UNCTAD also expected that the EU will result in earning $2.5 billion from carbon border tax while developing countries will result in losing $5.9 billion. Billions worth of Indonesia exports, including chemicals and palm oil, will be subject to carbon border tax.

Impact on China

The EU is China’s second-largest exporter. Local industries in China, such as cement, fertilizer, steel and plastics will see higher import costs once the carbon border tax is fully implemented. Some analysts estimated that it will increase export costs by 17% to 31%, which is an ample amount for industries. According to Wang Junfeng, Director of Nankai University’s Center for Resource, Energy and Environmental Policy, the share of electrical and mechanical products accounted for almost 60% of overall exports to the EU in 2021. The local industry will be affected if carbon border tax applies to the electrical and mechanical industry and automotive industry. Therefore, China’s export competitiveness will be further weakened by the tax.

How Businesses Adapt to Carbon Border Tax

Businesses should be prepared for CBAM compliance as soon as possible. Some researchers from Taiwan anticipated that Taiwan will be required to pay up to NT$36 billion under carbon border tax in 2026. This will significantly affect the cement and metal industries.

Therefore, Taiwan businesses are actively adopting carbon pricing strategy in response to the new tax. This is because the EU will lower or exempt its duty to avoid double taxation if the country has adopted similar strategy to its carbon pricing. Right now, Taiwan is actively drafting carbon pricing strategies to achieve carbon border tax exemptions for its local businesses in the near future.

FreightAmigo: AmiGo Green Achieves Carbon Emission Reduction Goals for Business Clients

Businesses recently have focused on achieving carbon emissions reduction targets. However, they should not overlook the carbon emissions produced during logistics as well. About 70% of transport-related greenhouse gas emissions come from road travel in Europe. If you want to reduce carbon emissions and achieve sustainable development, green logistics can be an option.

To assist people from industry sectors in achieving green goals, FreightAmigo has made no compromises in launching AmiGo Green, a project aimed to reduce carbon emissions. AmiGo Green offers digitized shipping documents, green freight route quotations, and carbon emission calculators to support your company’s efforts in reducing carbon emissions and saving energy.

Let’s achieve carbon emission reduction goals with FreightAmigo and make trade greener together!

===

Prefer a greener logistics solution?

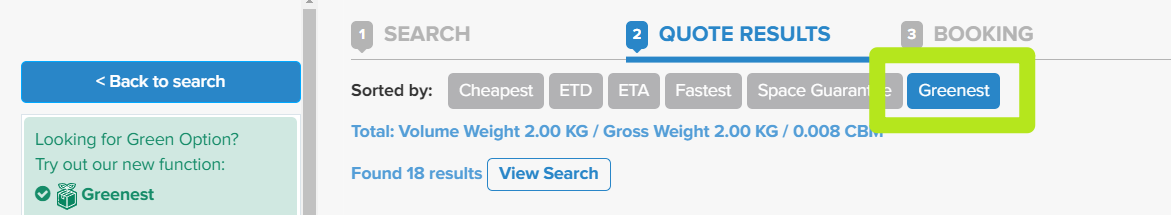

After searching for shipment quotations in FreightAmigo, select [ Greenest ] in [ Sorted by ], and you can compare the CO2e of each shipment solution immediately! Let’s Make Trade Greener.

===

Register for free and experience the new era of FreighTech x FinTech. If you have any questions, welcome to

Chat online / WhatsApp: +852 300898592