Author Name: Fan Wong – Marketing Analyst at FreightAmigo|22/9/2022

Subsequent to the implementation of BNO Visa, several Hong Kong residents have embarked on preparing for a new life in Britain. Before setting out, remember to apply for the ToR (Transfer of Residence)! In your first year of immigration, you can enjoy a tax-exemption for your belongings which you have used for at least 6 months. FreightAmigo can provide more details about the tariffs and restricted items, allowing you to save money!

What is ToR?

ToR is a declaration document submitted to British Customs, which can be said to be a mandatory document for immigrants to move their house. Prior to the application for ToR, you need to fill in your personal information, Hong Kong and UK residence addresses, list and quantity of items. In the first year of immigration, you can ship personal items which has been used for more than half a year duty-free. The application procedures can be completed on the HMRC website.

What conditions must the applicant and the goods to be shipped meet to qualify for ToR and tax exemption?

- Having lived in a country other than the United Kingdom for 12 consecutive months before emigrating to the United Kingdom

- The articles have been used for more than 6 months

- Articles enter the UK within 12 months of your arrival

- The articles will continue to be used for more than 12 months after entry, and may not be resold, lent, leased or given to others

- Applications for tobacco, alcohol, commercial vehicles, perfume, contraband and restricted articles are not accepted

What requirements have to be fulfilled for applying ToR online?

- The list and quantity of items (the name of items must be filled in in detail, e.g., “Rice cooker”/ “Microwave” instead of “Kitchenwares”

- Passport (including photos and signature page)

- The address proof in Britain (e.g., electronic bill, rent contract; you can provide your short-term address such as hotel or AirBnB if you have no exact residential address. If you plan to stay at a local friend’s residence first, you can also invite your friend to provide a statement of CO-residence and proof of address)

- Proof of address in Hong Kong issued within 3 months before going to the UK

After your ToR application has been approved, you will receive an email confirmation and a unique reference number (URN). This number usually consists of 7 digits, and the last two digits represent the year of application. For example, < 12345-21 > represents the application in 2021. If the goods listed in the goods list will be sent through air freight or sea freight, you only need to apply for ToR once and use the same URN to process customs clearance. If you intend to ship other items that are not on the list within 12 months after your arrival, you need to reapply for ToR.

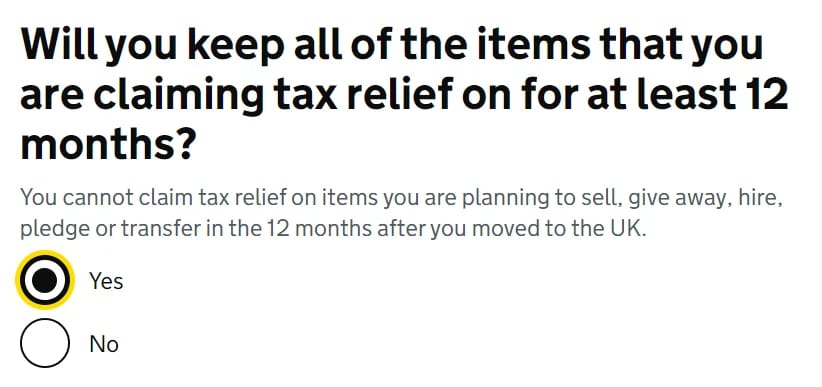

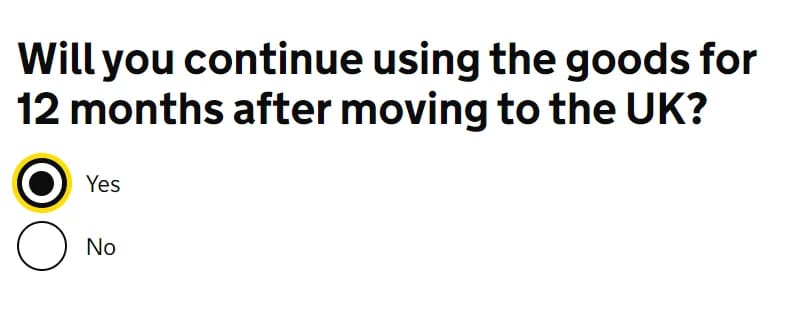

Some sample questions for online application:

You must choose “yes” for the above questions; otherwise, your application result would be affected.

After your ToR has been approved, you will receive an email confirmation and a unique reference number (URN). This number usually consists of 7 digits, and the last two digits represent the year of application. For example, < 12345-21 > represents the application in 2021. If the goods listed in the goods list will be sent through air freight or sea freight, you only need to apply for ToR once and use the same URN to process customs clearance. If you intend to ship other items that are not on the list within 12 months after your arrival, you need to reapply for ToR.

Suggested sequence of overseas house moving

When is the most appropriate time to apply for the ToR? At which stage should I apply for ToR when I move overseas? Before departure, after sailing, or after arriving in Britain? If URN cannot be provided, customs may charge tax when goods are cleared, as well as additional warehouse fees as a result of the delay in customs clearance. As the approval time may take up to 6 weeks, to be safe, please refer to the following order:

- Inquire quotation and collect packaging materials

- Pack and prepare the goods list and apply for tor

- Contact the overseas house moving company to collect the packed articles and cartons, and provide documents (packing list, visa copy of passport, URN)

Must-read items for relocation to Britain! List of prohibited items

The UK lists the following items as prohibited items:

- Regulated drugs and drugs

- Offensive weapons (such as spring knives, firearms), self-defense sprays (such as pepper spray and tear gas), ammunition and explosives

- Indecent and obscene articles

- Radio transmitters not permitted for use in the UK

- Any poultry meat and milk, and its finished products

- Plants, plant products (such as vegetables, fruits, potatoes), seeds

- Endangered animals and plants

- Raw drill without processing

- Pirated goods

In order to avoid the whole batch of goods being comprehensively inspected or even detained, please avoid shipping the above goods to the United Kingdom. The latest information is available on the websites of HMRC and British customs.

It is not easy to deal with the complicated regulations regarding prohibited items or tariff arrangements. Do not want to spend time dealing with these issues but still want to send your beloved goods to your new house safely? You had better have the full support of logistics experts! Visit FreightAmigo’s Relocation Freight Quotation Page, and you can get rid of all of these at your fingertips.

If you want to get more information on relocation,you can Whatapp +852 30089859 and contact our relocation experts

===

More information about international relocation:

Parcel to United Kingdom | The Cheapest Courier HK to UK

Relocation To United Kingdom – Customs Clearance & Restricted Items

Best price in town! Sending documents from HK to UK, only $176

===

FreightAmigo provides instant quotes for more than 250 countries, helping you save the cost. Our cargo tracking system connects more than 300 shipping companies. You can get the latest status after placing an order.

Register for free | Download FreightAmigo APP