Author Name: Tiffany Lee – Marketing Analyst at FreightAmigo

A piece of cargo has the potential to be taxed when it is imported or exported internationally. Each country or region has its tax policies and trade restrictions. Because of this, you must do your research and understand duties and taxes before making any purchases or sending gifts to family and friends who live abroad. Let’s learn more about duties and taxes with FreightAmigo and make trade easier for everyone!

What are Duties and Taxes?

Duties

Duties is a tax that imposed on cargo when it is imported or exported. Customs import duty, customs export duty, and special customs duty are the three most popular types of duties.

Taxes

Taxes are being collected by governments on a variety of goods and services in some countries or regions. While most European nations refer to this tax as Value Added Tax (VAT), countries like Canada, Australia, New Zealand, and Singapore refer to it as the Goods and Services Tax (GST). Besides being paid by customers, this tax is also gradually added to the cost of manufacturing and distribution. In 2006, Hong Kong held consultations for the implementation of GST, however, the program was finally abandoned.

Importance of Duties and Taxes

Importance of Duties

For countries with developed trade, duties are the primary source of national fiscal revenue. To safeguard domestic industry and raise tax income, government imposes duties. Duties can decrease foreign competition and boost the competitiveness of domestic industries because taxed imported goods are often more expensive than domestic ones. For instance, Taiwan charges a 17.5% duty on imported cars, which raises their average price and fosters the growth of domestic car industry.

Importance of Taxes

Since GST/VAT is less affected by economic variations than other taxes, it provides the national government with substantial and stable fiscal revenue and enables it to withstand unexpected financial pressures. France was the first nation to impose the GST in 1954, and now it becomes one of the major government revenue sources. In 2020, 45% of the French government’s revenue came from GST.

How to Collect Duties and Taxes?

Collect Duties

The trade laws, duties rates, and dutiable items are unique in each country or region. Duties are calculated based on:

- Shipping Destination

- Goods type and value

- Quantity

Collect Taxes

Daily necessities may be excluded from taxation in some countries and regions, and each country or region has a distinct GST/VAT tax rate.

What are the Duties/Taxes in Different Countries or Regions?

Duties in Different Countries or Regions

Hong Kong’s Duties

The Hong Kong Special Administrative Region is a free trade port, according to the government’s Policy on Import and Export Goods. Except for four types of dutiable commodities which are liquors, tobacco, hydrocarbon oil and methyl alcohol, other imported and exported goods are not subject to duties.

Learn more about Hong Kong’s policy on import and export goods: https://www.tid.gov.hk/english/import_export/ie_policy.html

China’s Duties

According to the World Trade Organization (WTO), the average duties rate on imported agricultural commodities is 7.3% higher than that on non-agricultural commodities. This helps to lower the competitiveness of imports that pose a threat to China’s economic interests. The Closer Economic Partnership Agreement (CEPA) between Mainland China and Hong Kong and Macau has also been signed. The commodities can be imported into the mainland with zero duties as long as they are made locally and follow the rules of origin.

Learn more about CEPA: https://www.tid.gov.hk/tc_eng/cepa/cepa_overview.html

Taxes in Different Countries or Regions

Canada’s Taxes

Why does the price at the cashier in Canada different from the price listed? It is billed together at checkout since tax is not included in the amount stated on Canadian goods. Since 2008, Canada’s GST has been cut to 5% and many daily necessities are now exempt from it.

Singapore’s Taxes

Singapore’s GST rate is now 7%, but the government intends to gradually raise it to 9% in 2023 and 2024 to raise capital for social infrastructure projects.

Customs regulations and taxes for various goods are different in every country. If you still have questions about duties and taxes when planning your shipment, or other shipping queries, you are welcome to contact FreightAmigo and our customer service specialists at any time.

===

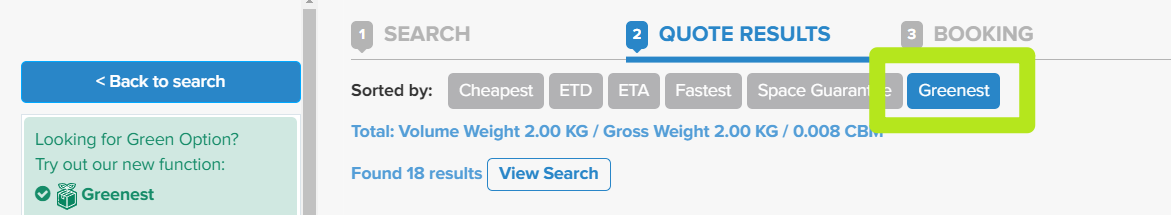

Prefer a greener logistics solution?

After searching for shipment quotations in FreightAmigo, select [ Greenest ] in [ Sorted by ], and you can compare the CO2e of each shipment solution immediately! Let’s Make Trade Greener.

===

Register for free and experience the new era of FreighTech x FinTech. If you have any questions, welcome to

Chat online / WhatsApp: +852 300898592