Author Name: Emma Lui – Marketing Analyst at FreightAmigo

When conducting declarations, importers need to submit large numbers of documents and invoices. If they fail to provide accurate information, this may result in cargo delay as customs may hold your cargo. ‘Commercial Invoice’ is one of the crucial documents in custom clearance, which is also the key to ensure a smooth customs journey. Let’s learn more about ‘Commercial Invoice’ and its function in logistics with FreightAmigo!

What is ‘Commercial Invoice’?

‘Commercial Invoice’ is an essential document in customs clearance during international trades. Also, it is issued by a consignor or agent to buyers for fee request. ‘Commercial Invoice’ should include detailed information about the cargo including destination, payment methods, trade terms, etc. During cargo import and export, customs will assess the amount of taxes and tariffs by inspecting the content of the invoice. If the information is clear and accurate, cargo clearance will be more effective!

What is the difference between ‘Commercial Invoice’ and ‘Pro forma Invoice’?

‘Pro forma Invoice’ is not an official invoice. During quotation stage, this invoice helps buyers estimate the import cost of cargo before arrival.

Since ‘Pro forma Invoice’ also mentions the value of cargo and related costs, people can submit the invoice to customs to declare the cargo value.

What can we do with ‘Commercial Invoice’?

Understand its importance!

- Payment basis

Before paying cargo fee, buyer (importer) can fully understand the detail of cargo and related cost, making the transaction much more transparent.

- Tariff Valuation

‘Commercial invoice’ submitted by the exporter to the customs is regarded as a declaration invoice. Customs will then use it as a basis to calculate tariff. Any discrepancies between the written content and the reality may extend the inspection period. (e.g. If you mark down the cost instead of transaction value in your commercial invoice, this will be regarded as misinformation.)

- Accounting Basis

Detailed information on each international trade between companies, such as the trading parties, expenditure, description of goods, commercial invoice number, etc., should be thoroughly recorded by account department.

How to fill in ‘Commercial Invoice’?

- Contact of seller and buyer (Full name, company name & address, contact number, etc.,)

- Sales location and time or shipping location and time

- Detailed cargo description (quantity, total weight, size, quality, unit price, etc.)

- Subsidy and rebate for cargo exports

- Cargo arrival

- Payment terms (shipping cost, packaging costs, discounts, inland haulage charge, etc.)

- Harmonized System (HS) Code, etc.

Learn more about HS code: 【Logistics 101 】What is HS Code? | FreightAmigo

If you still have a question about ‘Commercial invoice’ when planning your shipment, you are welcome to contact FreightAmigo and our customer service specialists at any time.

===

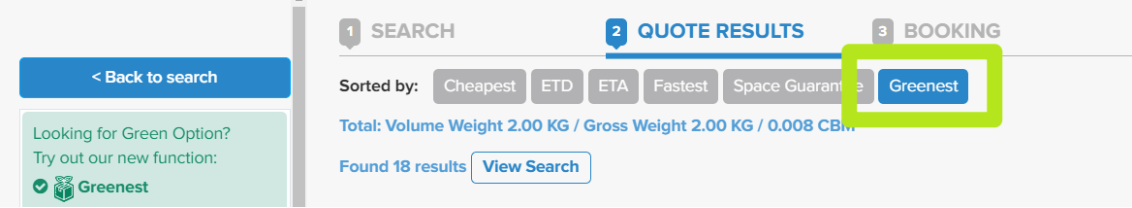

Prefer a greener logistics solution?

After searching for shipment quotations in FreightAmigo, select [ Greenest ] in [ Sorted by ], and you can compare the CO2e of each shipment solution immediately! Let’s Make Trade Greener.